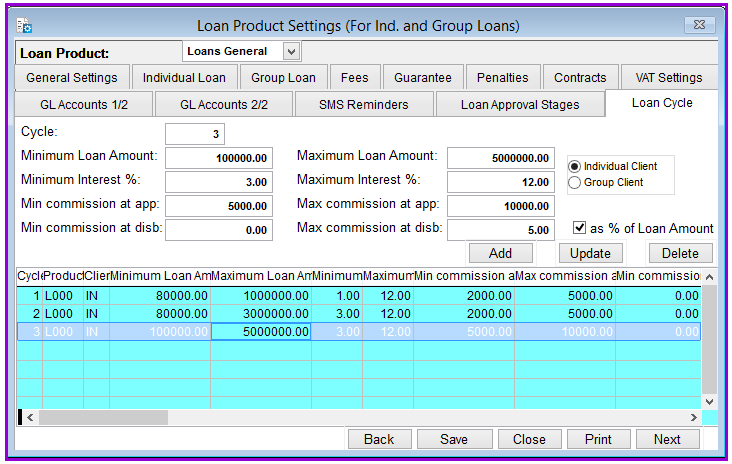

Loan Performer allows you to set the limits for the loan amounts, interest and commission charged for loans in different loan cycles for particular Loan Product.For groups the cycle is defined by the group, not the group member.

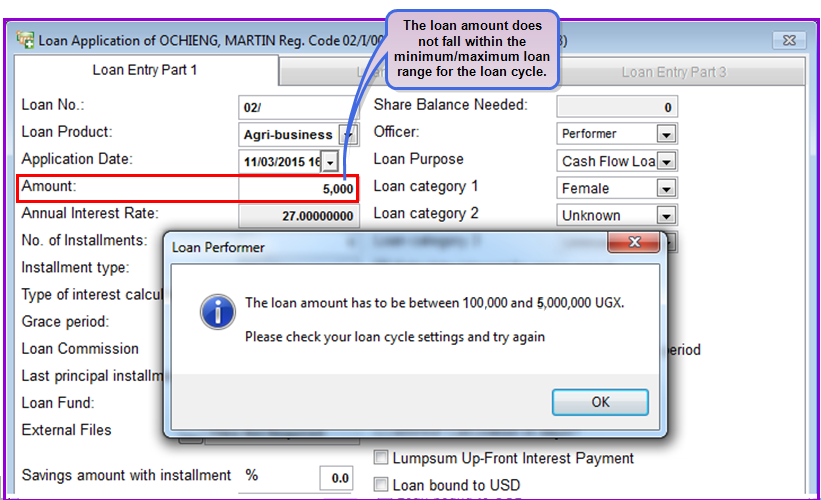

On the Loan Cycles page you will be able to enter the minimum and maximum loan amounts, interest and commission for the various loan cycles. This means that, for a particular cycle, you will not be able to issue or charge loans that are below or beyond the limits set.

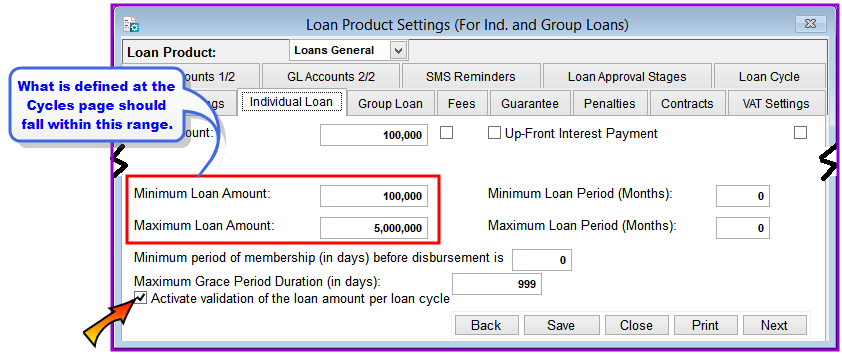

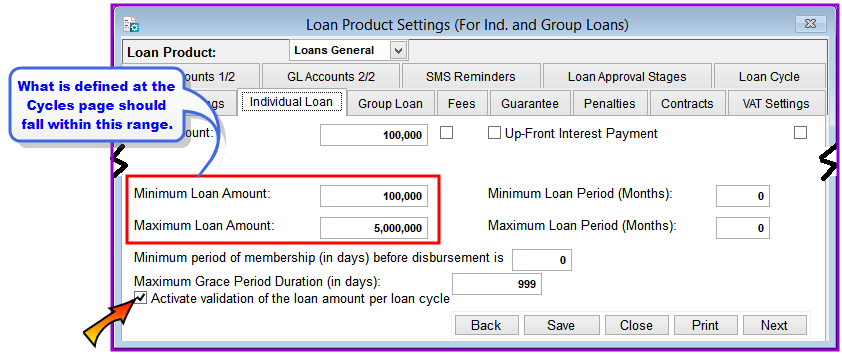

For you to be able to use the loan cycles settings you have to activate the Activate validation of the loan amount per loan cycle. option.

How to set loan cycles

To set loan cycles you go to System/Configuration/Loan Product Settings/Loan Cycles and the following screen will be displayed:

Note that the minimum/maximum amount set at the Individual loan or Group loan page gives the full range of limits for the product and takes precedence over any other limits set else where in Loan Performer. Therefore what is defined at the cycles page should fall within this range.

Click on the Add button to add the newly defined loan cycle and repeat this for all the cycles that you want to register in Loan Performer.

Click on the Close button to exit.

The Nº 1 Software for Microfinance